Heloc amortization period

All closing credits paid by APFCU must be reimbursed if the loan is closed before. You also have the option to lock all or part of your outstanding HELOC balance into a fix-rate option during your draw period.

America S Best Places To Live 2022 Bankrate Best Places To Live Best Cities Real Estate Houses

Once your right to cancel period has expired the funds from your home equity line of credit will be available.

. When using a primary residence as collateral a three business day right to cancel rescission period is required by law to allow applicants the opportunity to cancel their home equity line of credit application. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. This tool is designed to show you how compounding interest can make the outstanding balance of a reverse mortgage rapidly grow over a period of time.

C the loan with the lowest rate for which the consumer qualifies for a loan without negative amortization a prepayment penalty interest-only payments a balloon payment in the first 7 years of the life of the loan a demand feature shared equity or shared appreciation. Do you want to estimate what your remaining equity balance will be a few years out from today. Available loan amounts for HELOCs and.

HELOC offer greater flexibility like the ability to pay interest-only for a period of time and then switch to a regular amortizing or balloon payment. Bear in mind of course that either a home equity loan or HELOC will put you deeper into debt which could be a problem if you suffer a serious financial reversal due to a job loss large medical. Since the homeowner is applying for a hybrid HELOC the maximum amount available for the line of credit is 80 of the home value.

During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line. Or in the case of a reverse mortgage a loan without a prepayment. Generally HELOCs come with a repayment period between 10 20 years attached.

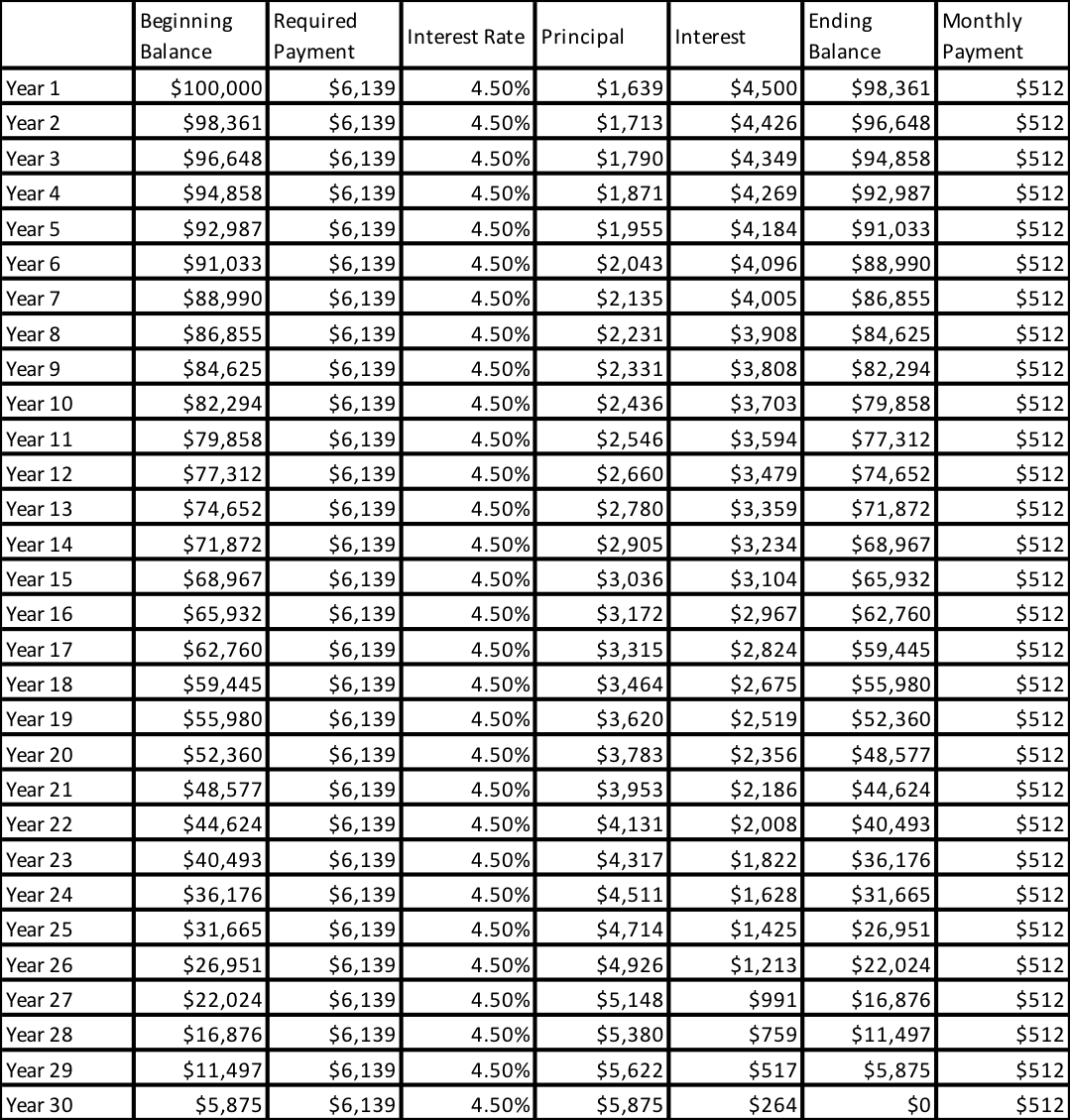

Following the draw periods expiration the repayment period begins. The HELOC amortization schedule is printable and you can export it to excel or as a pdf file. You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only monthly payments.

During your repayment period youll no longer have access to funds via the HELOC and will be required to make monthly payments until the loan is fully paid off. If the frequency or amount of your mortgage payments changes then your amortization period will also change. The draw period is the phase.

As noted in the interest-only payment section above many HELOCs will require you to pay a fully amortized payment and this amortization period is often 20 years. Mortgages for homes valued at less than 1 million with a down payment of less than 20 of the purchase price in Canada have a maximum amortization period of 25 years. Typically it is 5 or 7 years though in some cases it may last either 3 or 10 years.

Some hybrid ARM loans also have less frequent rate resets after the initial grace period. Then as the COVID-19 crisis struck interest rates crashed to the floor shifting homeowner. As the Federal Reserve has lifted short-term interest rates in the late 2010s many homeowners who typically opted for the cash-out refi option in the prior decade became more inclined to use a home equity loan or line so they keep their existing low rate on the majority of their home debt.

If you compared this with a traditional cash-out refinance of a first mortgage which would typically amortize over 30 years the HELOC payment will be meaningfully higher. The appraised home value is 1250000. 15000 to 750000 up to 1 million for properties in California.

A home equity line of credit or HELOC ˈ h iː ˌ l ɒ k HEE-lok is a loan in which the lender agrees to lend a maximum amount within an agreed period called a term where the collateral is the borrowers equity in their house akin to a second mortgageBecause a home often is a consumers most valuable asset many homeowners use home equity credit lines only for. 6 Primary residence HELOC has no credit union closing cost annual fee or prepayment penalty. Your HELOC acts more like a credit card while still being secured by your home and you use and repay as needed but you have a cap on the credit account.

A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home. Monthly payment Interest Only. Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments.

The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie. Most personal loans fund a lump sum amount upfront and require you to pay it back with monthly payments over a set period of. In Canada you must be at least.

Lenders typically loan up to 80 LTV though lenders vary how much they are willing to loan based on broader market conditions the credit score of the borrower. HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. The amortization period is based on a set number of regular and constant mortgage payments.

To see this view click on show. Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal. In addition to calculating your total interest paid the student loan calculator above shows you how much of your monthly payment goes toward interest.

Regardless of the price of your home if you make a down payment of at least 20 you are able to access a mortgage that. HELOC Payments How are HELOC repayments structured. For this hybrid product the HELOC portion is 65 while the amortizing mortgage portion is 15.

Instead interest is added to your mortgage balance. The HELOC repayment is structured in two phases. 500 discount on 3rd party fees 250 - 3800 estimated for loans up to 400000 and maximum combined loan-to-value of 80 with an initial draw of 10000 at closing.

Below is the calculation for Homeowner As maximum HELOC credit limit. For example a 55 ARM would be an ARM loan which used a fixed rate for 5 years in between each adjustment. Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance.

A HELOC is a different type of second mortgage because like a home equity loan it is secured by the equity in your home but it operates differently than a more traditional home equity loan. When you have a HELOC you may be charged a small nominal annual fee - say 50 to 100 - to keep the line open but you do not accrue interest until you draw on the line. But while a HELOC lets you draw on.

A hybrid ARM has a honeymoon period where rates are fixed. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. HELOC you do not have to make any payments at all.

Use this free calculator to help determine your future loan balance.

Mortgage Amortization

Interest Only Heloc Explained Nextadvisor With Time

Estimate The Average Number Of Days It Takes The Company To Collect Its Receivabl Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Payment

Home Equity Loans How They Work And How To Use Them

How To Refinance A Heloc 5 Ways Bankrate Home Home Repairs Home Equity

What Is A Heloc And How Does It Work Rodgers Associates

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How A Heloc Works Tap Your Home Equity For Cash

What To Know Before Your Heloc Draw Period Ends Nextadvisor With Time

What Is A Heloc And How Does It Work Rodgers Associates

What Are Home Equity Loans A Guide For Canadians Canadian Mortgages Inc

Bi Weekly Amortization Schedule How To Create A Bi Weekly Amortization Schedule Download Thi Amortization Schedule Excel Calendar Template Monthly Calender

How A Heloc Works Tap Your Home Equity For Cash

What Is A Home Equity Line Of Credit Heloc How Does It Work In 2022 Home Equity Line Of Credit Equity

Heloc Calculator

What Is An Amortization Period Home Equity Solutions

Gue31bu89cdujm